Many times when I am working with people and talking about their mortgage payment, we get into the details of escrow accounts, taxes, insurance, mortgage insurance – etc. Generally, the discussion starts by someone asking a question like:

How much will my mortgage payment be for a $200,000 loan?

And because I can’t immediately say $1,834.43 for a 30 year fixed rate loan… that is where the discussion starts.

What Makes Up My Mortgage Payment?

The official mortgage-speak term for the numbers that make up your mortgage payment are PITI. PITI stands for Principal, Interest, Taxes and Insurance. PITI is broken down nicely on your Good Faith Estimate (you should always get one of these from your loan officer) down in the bottom right hand corner. It will look something like this:

Principal and Interest – The principal and interest are calculated based on your loan amount and whatever the interest rate is.

Taxes – Your taxes are set by the government for the community you live in. This number is easily found at the Maricopa County Assessors office and can also be disputed if you think the assessed value of your home is too high.

Insurance (Hazard) – This is the amount that you pay each month for your homeowners insurance. Normal people call it “homeowners insurance” – mortgage people call it “hazard insurnace”. These are the same thing. One of the quickest, easiest ways to save money on your mortgage each month is to check the homeowners insurance rates that you are paying and make sure that they are “in the ballpark” of what other companies are charging.

Insurance (Mortgage) – Mortgage insurance is the amount that you pay to a private mortgage insurance company if needed. For government loans, it will be paid to FHA, for conventional loans requiring mortgage insurance, it will be paid to a private mortgage insurance company. Mortgage insurance is not for your benefit – it is for the benefit of the lender.

Once you know what numbers make up PITI – you now can break down the different ways to save money on your mortgage payment. Get the lowest interest rate possible with the lowest loan amount. Shop around for hazard insurance. Dispute your assessed value for tax purposes. Try to avoid mortgage insurance.

Do all of these things, and you will save money — and you might be surprised how much money I see people save just by shopping around a little bit.

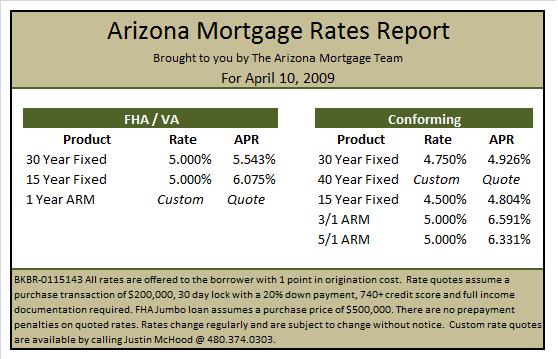

Arizona Mortgage Rates for April 10 2009

Speak Your Mind