If you haven’t heard by now the Congress has extended and expanded the homebuyer tax credit. Both the House and the Senate passed an Unemployment Insurance Extension bill that includes an amendment that extends and expands the homebuyer tax credit. The bill is expected to be signed into law by President Obama today.

Is anything different about this homebuyer tax credit?

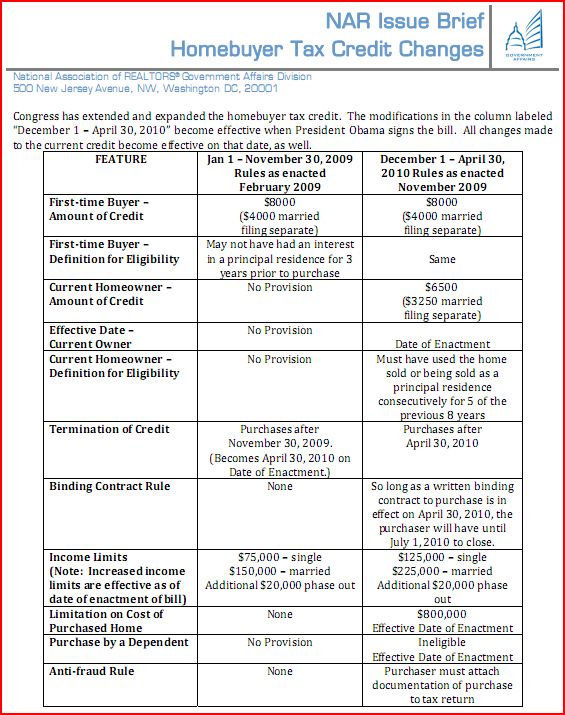

The $8,000 credit for first time homebuyers remains intact but has been expanded to include current homeowners. If you have sold or currently own a primary residence for 5 of the last 8 years, you are eligible for a $6500 tax credit, $3,250 if married and filing separately. There have also been some income limits imposed as well as a deadline to be under contract, not close the transaction, by April 30, 2010. You will also notice a limit on the cost of the purchase at $800,000.

The comparison chart below provided by the National Association of Realtors will help. Click here for a PDF of the chart.

Update: This afternoon President Obama signed the Worker, Homeownership, and Business Assistance Act of 2009 into law. The law takes effect December 1, 2009.

We purchased out 2nt home in Jan of last year and we miss out on the tax credit buy a very few mouths, we need help also. When I talk to the people at the IRS they tell me No Provision. I wish some one would take up for the people that fall between the cracks. I dont work cant find a job my husband works that tax credit would really help alot.

Thanks