![]()

As the number of bank-owned properties here in Arizona continues to grow, so does the number of homes that Fannie Mae owns. As you can imagine, with any significant pool of homes that are owned by a lender, there are some homes that are immaculate and move-in ready and there are some homes that are in need of “a little work” before they are liveable.

The good news is that if you are in the market for a home and want to get a *smoking* deal on a house, Fannie Mae has designed two loan programs for homes that are currently owned by Fannie Mae and the loan programs are f-a-n-t-a-s-t-i-c.

One loan program is designed for homes that are currently owned by Fannie Mae and are move-in ready. The other loan program is designed for homes that are currently owned by Fannie Mae and in need of repair. The official name of the two loan programs are the Fannie Mae HomePath Mortgage and the Fannie Mae HomePath Renovation Mortgage.

Fannie Mae HomePath Mortgage Loan Highlights

The Fannie Mae HomePath mortgage loan is designed for people who are planning on making the property their primary residence and want to buy a home that is owned by Fannie Mae and found on the HomePath website.

HomePath mortgage loan benefits include:

- Low down payment and flexible mortgage terms (fixed-rate, adjustable-rate, or interest-only)

- You may qualify even if your credit is less than perfect

- Available to both owner occupiers and investors

- Down payment (at least 3 percent) can be funded by your own savings; a gift; a grant; or a loan from a nonprofit organization, state or local government, or employer

- No mortgage insurance

- No appraisal fees

- No declining markets policy

- No more than 10 financed properties

- No prepayment penalties

For those homes that are in need of a few repairs, Fannie Mae has the HomePath renovation mortgage.

HomePath renovation mortgages have these benefits:

- Financing to fund both your purchase and light renovation

- Low down payment and flexible mortgage terms (fixed-rate or adjustable-rate)

- Down payment (at least 3 percent) can be funded by your own savings; a gift; a grant; or a loan from a nonprofit, state or local government, or employer

- No mortgage insurance

If you are considering buying a home that is currently owned by Fannie Mae, be sure to look into the HomePath mortgage financing program. In an effort to lower the inventory of houses they currently own, some of the best deals in a long time can now be had — whether the home is move-in ready or is in need of “just a little work”!

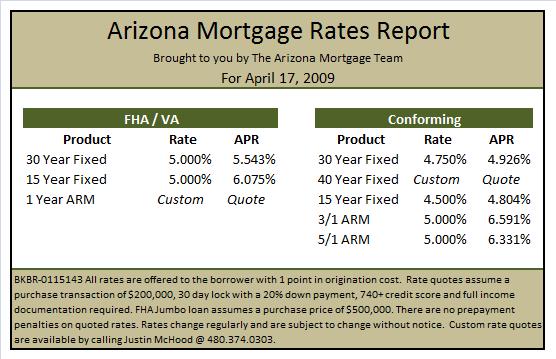

Phoenix Mortgage Rates April 17 2009

Speak Your Mind